In this case study, you will learn how to prepare tax return for couple. Clients’ information is as below.

Mary Black, living in Ottawa with his husband David Black, studies in college and works part-time. She has tax slips as below.

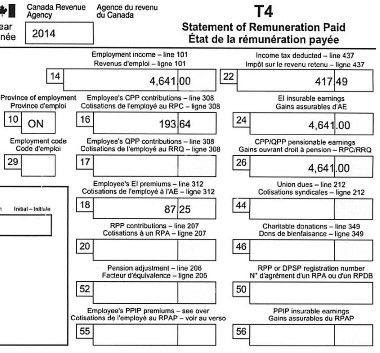

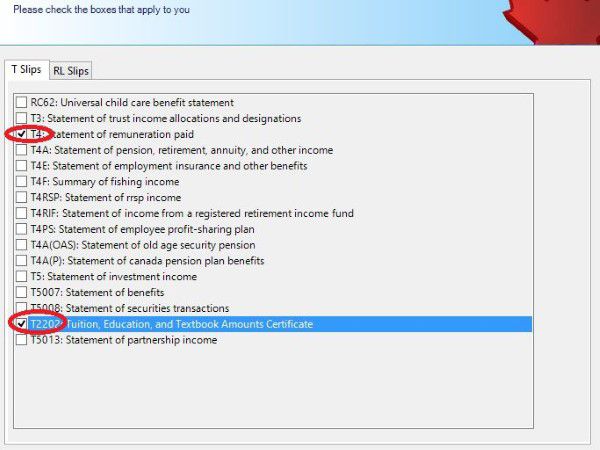

- One employment income tax slip T4.

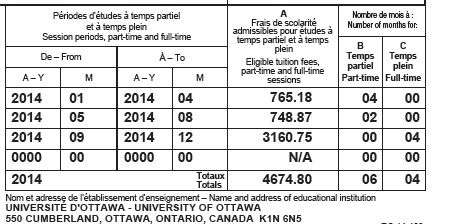

- Tuition and education amount tax slip T2202A.

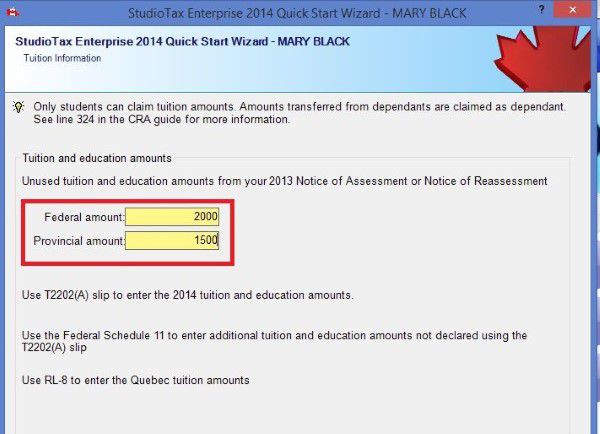

- She has unused Federal tuition amount $2000 and Ontario tuition amount $1500, which can be carried forward to this year tax return.

- She also has a U-pass for public transit. It costs her $500 in 2014.

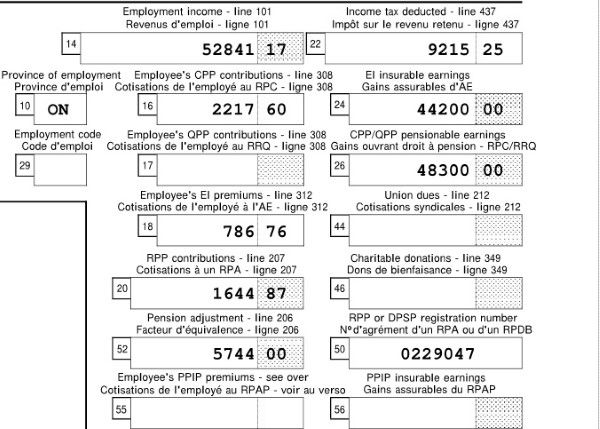

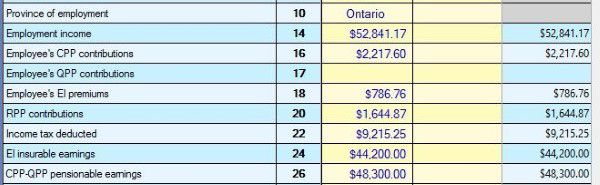

Her husband, David Black, works full time and has one T4 tax slip as below.

Let’s create a new file and prepare this tax return for couple from the beginning.

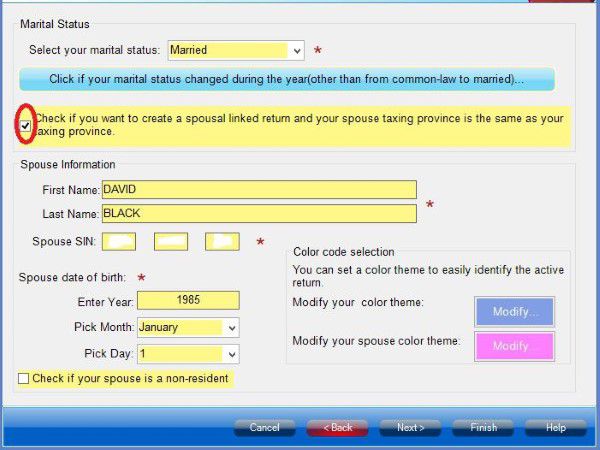

1. Input personal information in a tax return for couple.

Run Studio Tax, create a new file, and follow the wizard to input personal information for the tax return for couple.

On Marriage Stutus, choose “Married” and check “create a spousal linked tax return”.

If your marital status changes you must notify the CRA within a month. The CRA will recalculate your benefits such as Child benefits, GST/HST credits and Ontario Trillium Benefit based on your marital status change. Your benefits will be adjusted the month following the month in which your marital status changed.

You can do this by using “Change my marital status” on My Account or by calling 1-800-387-1193.

Click the link to read more about CRA online services.

2. Select tax slips.

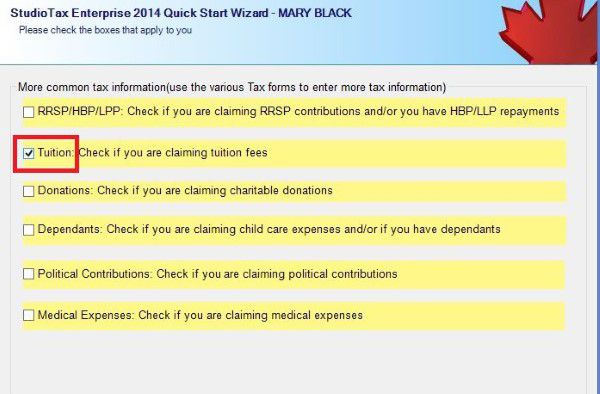

3. Check “tuition” box since she has unused tuition amount carried forward.

4. Input Mary’s T4 slip and T2202A slip.

5. Input unused tuition and education amount.

6. Input David’s T4 slip

7. Check the result in the tax return for couple.

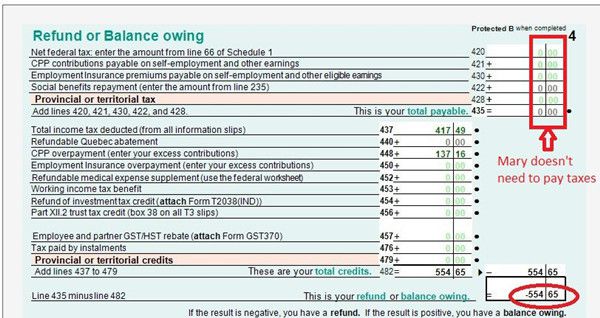

Mary’s tax refund is $554.65.

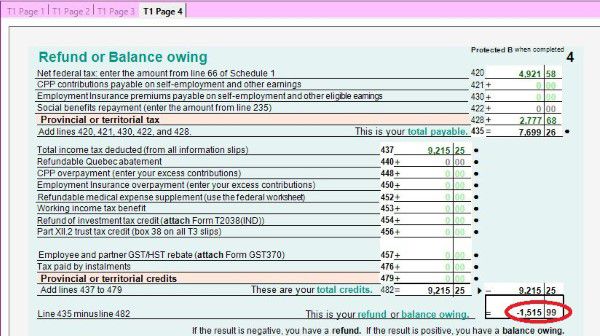

David’s refund is $1515.99.

8. Claim public transmit credit on the spouse return to maximizing tax saving on this tax return for couple.

You may notice I didn’t claim Mary’s $500 public transmit amount on her tax return. This is because it won’t get more tax refund for Mary by claiming this amount on her tax return.

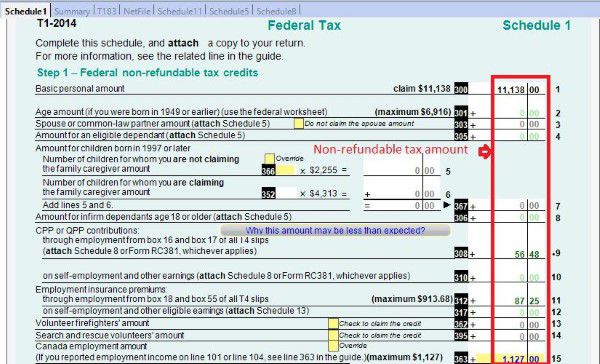

On Schedule 1, you can see Mary’s non-refundable tax amount, including basic personal amount 11,380 and Canada employment amount 1,127, is more than her income. Since she doesn’t need to pay tax, claiming more non-refundable tax credits won’t help her get more tax refund.

However, claiming the $500 public transmit amount on her husband tax return can increase his tax refund to $1590.99, saving tax $75 (15% of $500).

9. Transfer Mary’s tuition fee to her husband to get more tax refund.

Not only transmit amount, Mary can also transfer her tuition fee amount to her husband.

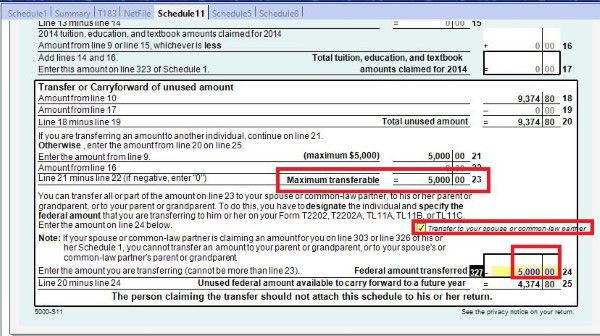

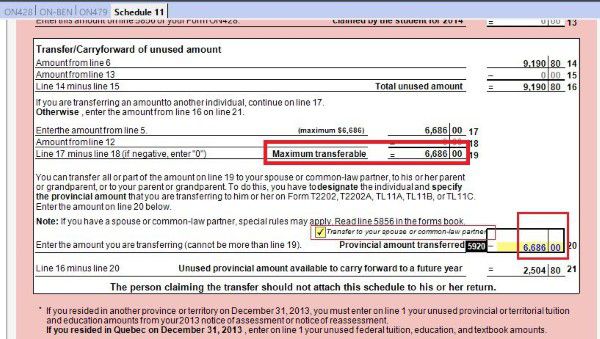

On Schedule 11, you can see the maximum transfer is 5,000, so you can check the “transfer to your spouse or common-law partner” and put 5,000 on the federal amount transferred.

On Schedule ON(S11), transfer the Ontario tuition maximum amount 6,680.

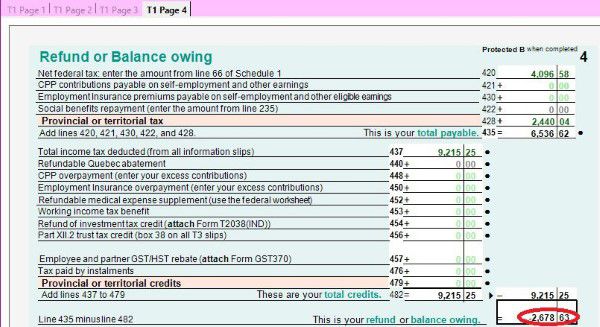

10. Check the result.

David’s tax refund is $2,678.63, increased $1,087.64 after transferred the tuition fee amount from Mary to David.

In all, while preparing tax return for couple, keep in mind there may be tax credits can be transferred to each other, and it will help to get more tax refund.

Click to read all articles about Tax Courses.