Through this case study, you will learn an important tax concept – tax deduction.

Tax deduction reduces your taxable income, thus lower your tax bill or increase your tax refund. Let’s see how tax deduction works by example.

Continue with case study 1.

John Smith, single, living in Ottawa, has T4 tax slips and pay rental payment $8000 in 2014.

Additional tax information for John Smith.

- He made $5000 Registered Retirement Saving Plan (RRSP) contribution.

- He paid $200 union due, which is not included in his T4.

- He has another T4 slip as below.

Let’s prepare his tax return step by step.

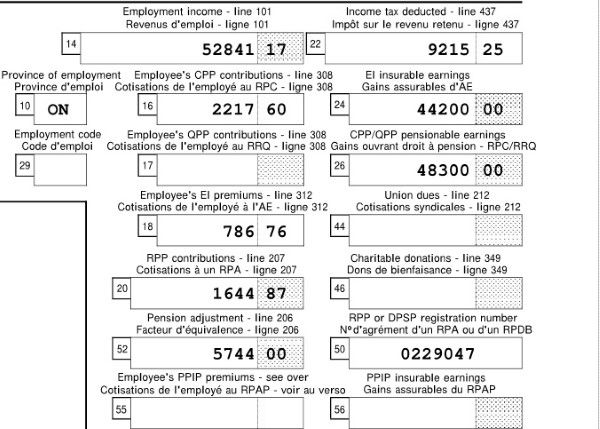

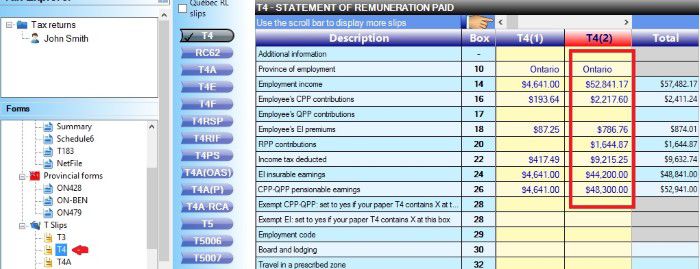

1. Input his T4 slip.

You can get the T4 slip form from wizard or just click T4 on the left, and then you will see the T4 form as below. Input the T4 slip’s data into the form

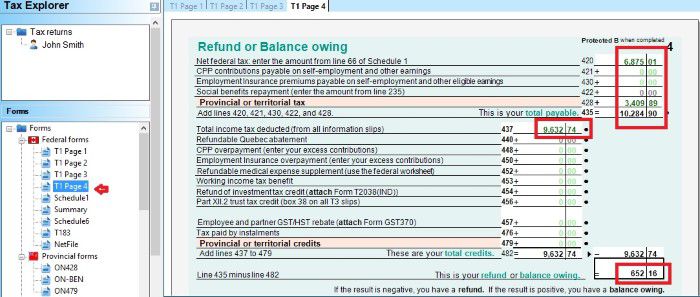

2.Go Back to T1 page 4 to see the result.

- Net Federal tax Line 420 is $6875.01.

- Provincial tax Line 428 is $3409.89.

- Total income tax deducted is $9632.74.

- Balance owing is $652.16. He has to pay taxes!

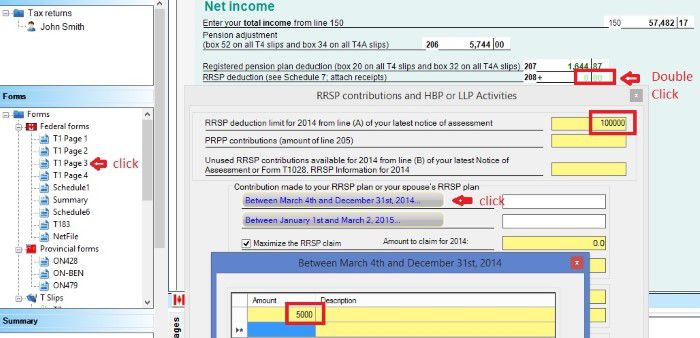

- Click T1 page 3 on the left.

- On page 3, double click RRSP deduction Line 208. A RRSP contribution form should pop up.

- On the RRSP contribution form, input $10,000 on the RRSP deduction limit. You can find your RRSP deduction limit on your latest notice assessment. Make sure the deduction limit is larger than your contribution amount.

- Click “between March 4th and December 31st, 2014″.

- Input $5000 to the pop up window, and then click OK.

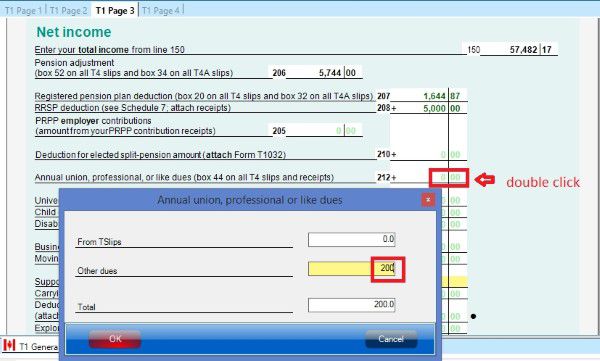

- On T1 page 3, double click Annual union, professional, or like dues on line 212.

- Input $200 on the other due in the pop up window, click OK.

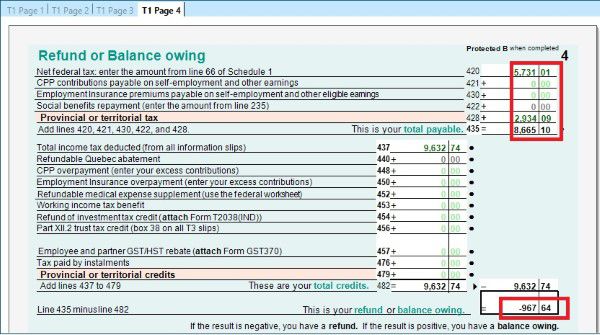

- Net Federal tax Line 420 is $5731.01.

- Provincial tax Line 428 is $2934.09.

You may also notice the working income benefit in line 453 become zero. This is because his income increases, he is not qualified for the benefit any more.

Now, let’s see how tax deduction reduces his tax owing.

3. Input his $5000 RRSP contribution.

Click to read more articles about RRSP.

4. Input union fee $200.

5. Check the result.

Now, he will get tax refund $967.64, instead of paying $652.16. By claiming tax deduction, he got tax saving $1619.8.

The total tax deduction we added is $5200 ($5000 RRSP + $200 union fee), so the saving rate of tax deduction is %31.15 (1619.8/52000), which is the same rate as his marginal tax rate.

Read the post Marginal Tax Rate – How You Get Taxed to know more about how tax deduction reduces taxes.

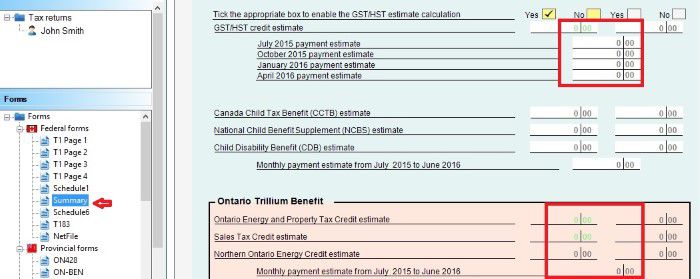

6. Get back to the summary.

He is not getting GST/HST and OTB credits any more, since his income increased.

Now you understand how tax deduction reduces taxes, in the next post, we will show you how tax credits save your taxes.

Click to read all articles about Tax Courses.