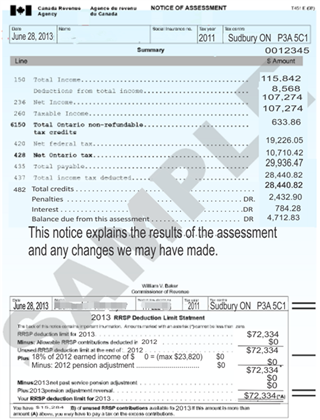

Starting in February 2016, you will receive a new Notice of Assessment (NOA) after filing your income tax return.

After you filed your income tax returns, Canada Revenue Agency will send you a Notice of Assessment. It usually takes up to 8 weeks to get it by mail. It is important to keep it on file because you will need it for many purposes such as mortgage loan, student loan application, retirement benefit application and child benefit calculating.

Your Notice of Assessment has important information for your tax planning and is also quite a useful document when preparing your next tax return. It includes:

Refund or balance owing:

The CRA’s Notice of Assessment lets you know if you are getting a refund or if you have a balance owing. You will also see if any corrections have been made to your tax return. For example, if you forgot to claim one of your T4 slip, the CRA will have added it to your tax return and adjust the result accordingly. If you claimed something you shouldn’t, the Notice of Assessment would indicate the change with an explanation. It will also tell you if they have charged any penalties or interest.

RRSP information:

You will see your RRSP deduction limit which represents the maximum amount that you can contribute to your RRSP. You can also see your unused RRSP contribution available for the next tax year.

Repayment required for the Home Buyers’ Plan:

If you have withdrawal money from your RRSP for the Home Buyers’ Plan (HBP), your first repayment starts the second year after the year you withdrew funds from your RRSPs for the HBP. Each year, the CRA will send you a Home Buyers’ Plan (HBP) Statement of Account in the Notice of Assessment to notice you the minimum repayment you have to make.

Tuition, education and textbook carry forward amounts:

If you are a college student and you pay tuition, you should claim your tuition and education amount, which will reduce your taxes when your income is high enough to pay taxes. In your Notice of Assessment, you can see the remaining amount so you can claim it in a future year when you have enough income to use them all up.

Unused net capital losses amount:

If you lost money in investment or business and you claim capital lost in your tax return, in your Notice of Assessment, you may see unused net capital losses amount which can be carried back three years and carried forward indefinitely to be applied against capital gains.

If you lost your Notice of Assessment, you can call CRA or you can sign up for the MyAccount service and access it there.